If you’ve ever wondered how investors decide what a medical office building, dental suite, or surgery center is worth, chances are the “cap rate” was part of the conversation. At first glance, it can sound like financial jargon, but once you break it down, it’s actually a simple tool that reveals a lot about the value of a property.

Whether you are thinking about buying a building for your practice, selling, or just curious how investors view healthcare real estate, understanding cap rates will give you a clearer picture of how value is measured.

What is a Cap Rate?

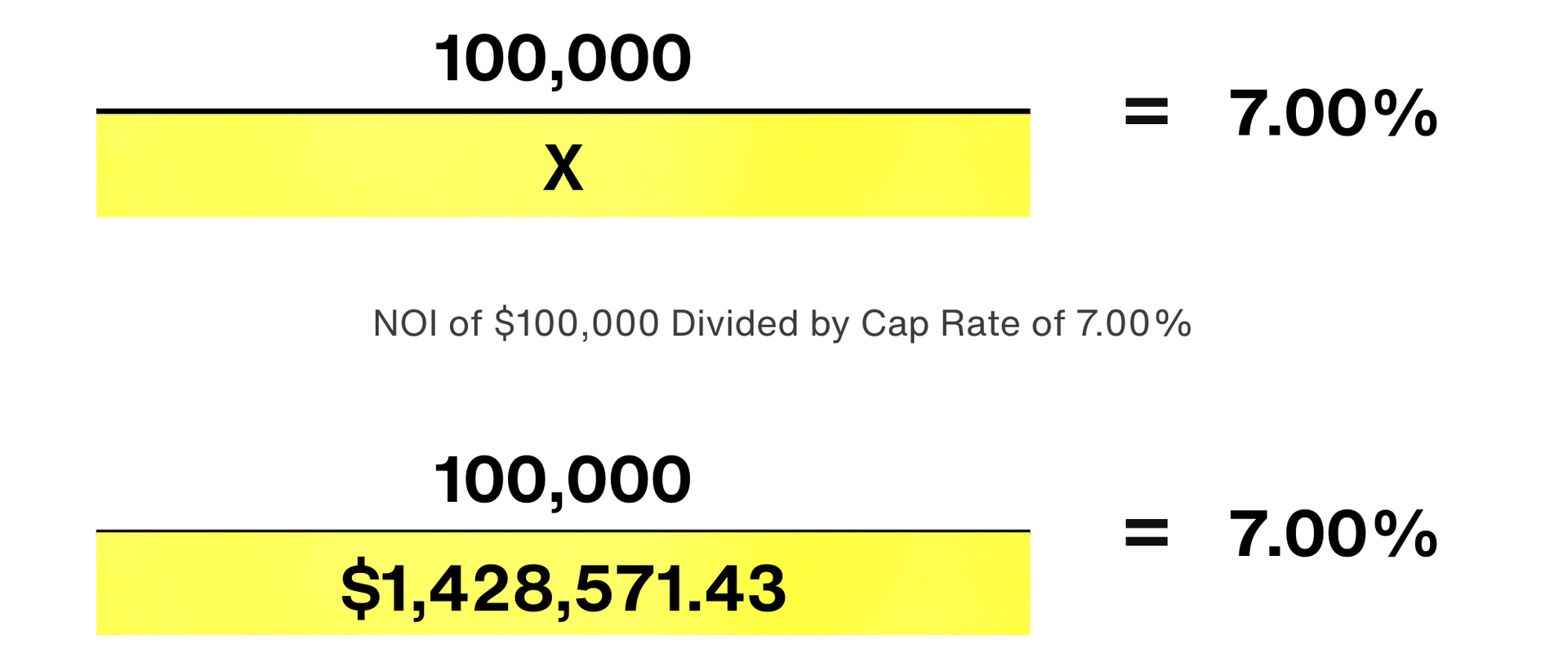

A cap rate, short for “capitalization rate,” is just a ratio that compares a property’s income to its value. The formula looks like this:

Net Operating Income (NOI) is simply the money the property brings in after paying operating expenses like maintenance, taxes, and insurance—but before things like loan payments or renovations.

A Simple Example

Let’s put it into numbers:

Suppose a medical office building generates $100,000 in annual NOI. Properties like this are currently selling at a 7% cap rate. That means the building’s value is about $1,430,000.

In plain terms, if an investor bought this building in cash, they’d expect about a 7% return per year from the income it produces.

What a Cap Rate Really Tells You

Cap rate is all about how much investors are willing to pay for a property’s income. The easiest way to see this is with numbers.

Let’s say a small medical office building has an NOI (income after expenses) of $100,000 per year.

- At a 5% cap rate: $100,000 ÷ 0.05 = $2,000,000 value

- At a 6% cap rate: $100,000 ÷ 0.06 = $1,667,000 value

- At a 7% cap rate: $100,000 ÷ 0.07 = $1,430,000 value

The income doesn’t change — the building is still producing $100,000 a year. What changes is what buyers are willing to pay for that income.

Here’s a real-world scenario: imagine two nearly identical buildings. One is across the street from a major hospital and fully leased to a group of specialists with long-term contracts. The other is in a less visible location with a history of tenant turnover.

The hospital-adjacent property might sell at a 5% cap rate (valued higher at $2,000,000), because investors see it as stable and low risk.

The less desirable property might sell at a 7% cap rate (valued lower at $1,430,000), because investors demand a higher return for taking on more risk.

That’s why cap rates and property values always move in opposite directions — the lower the risk, the more buyers are willing to pay for the same income.

When Cap Rates Don’t Work

Cap rates are not the best tool when cash flows are irregular or complicated. In those cases, investors use a more detailed approach called a Discounted Cash Flow (DCF) analysis. But for most stable income-producing properties, cap rates are the go-to method.

How This Applies to Your Practice

Cap rates aren’t just for big institutional investors. If you own (or are considering owning) your practice’s building, they matter to you too.

For example:

If you purchase a property with no tenants, its value is usually based on price per square foot. But once you set up your practice as a tenant and sign a lease, the building becomes an income-producing asset. That means an investor can now value it using a cap rate—and that can significantly increase the building’s worth.

This creates a powerful opportunity:

- Buy a building.

- Write yourself a favorable, long-term lease.

- Sell the building to an investor based on its new cap rate value.

- Keep the equity created in the process.

It may seem odd to sell a property right after buying it, but the asset you’re selling (an income-producing building) is very different from the one you purchased (a vacant or underutilized property).

The Bottom Line

Cap rates are one of the most important ways value is measured in commercial real estate. By understanding them, you’ll be able to see opportunities not just to own your space, but to strategically build wealth through it.